Onetick was relying on manual checks and confirmations, printouts, spreadsheets, and handwritten notes. This was time consuming for all parties, including the smash repairer, factorer and the underwriter that pays the smash repairer. As the existing risk and governance process is key to the business model and has contributed to their low bad debts, it was vital that it be maintained in any new solution as the business switched to higher volume operations.

The Solution

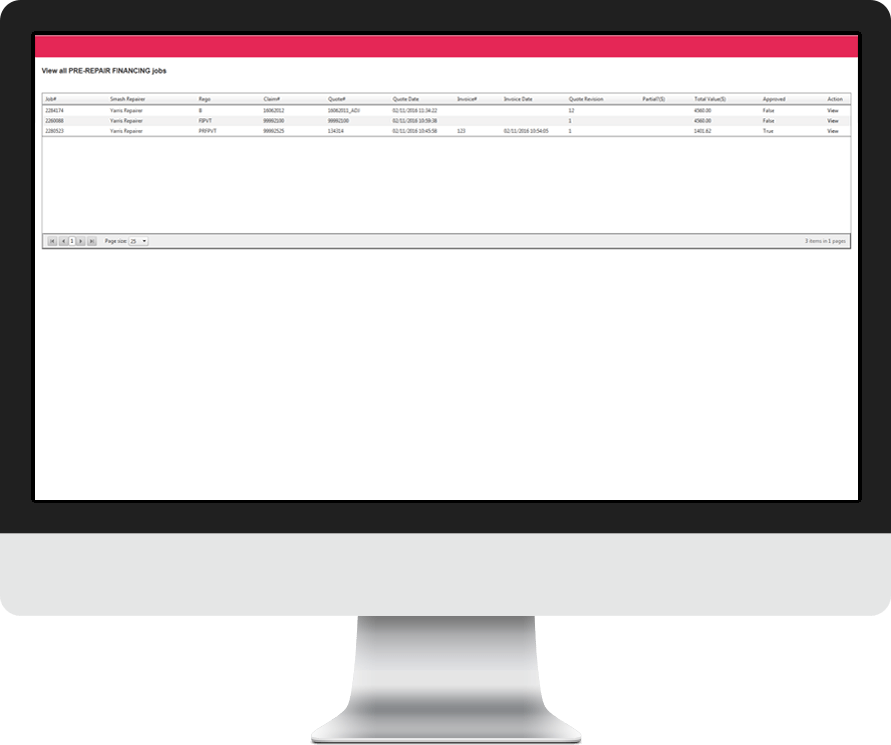

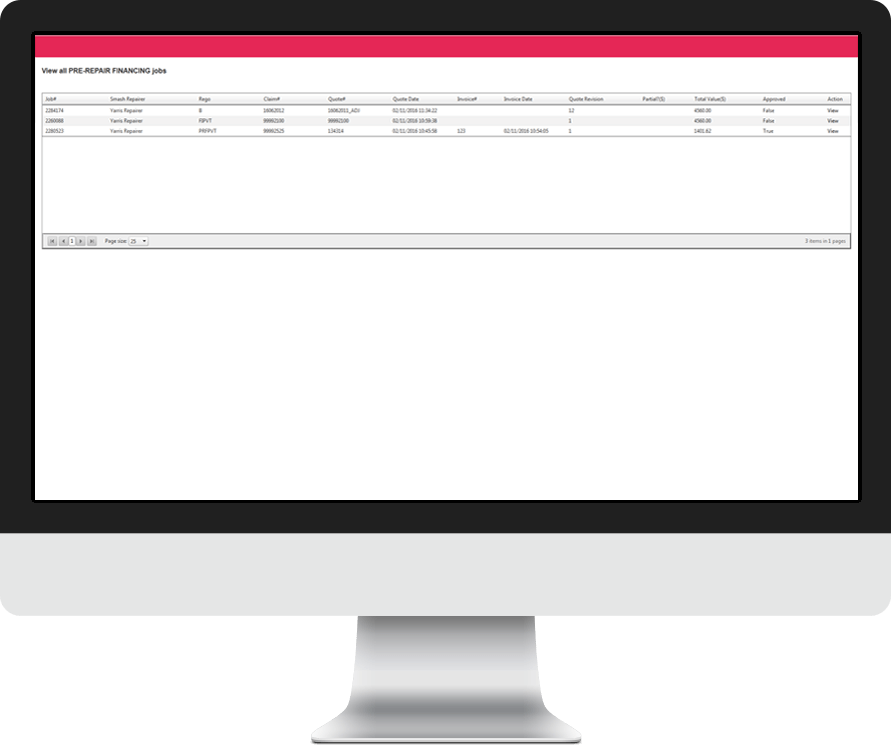

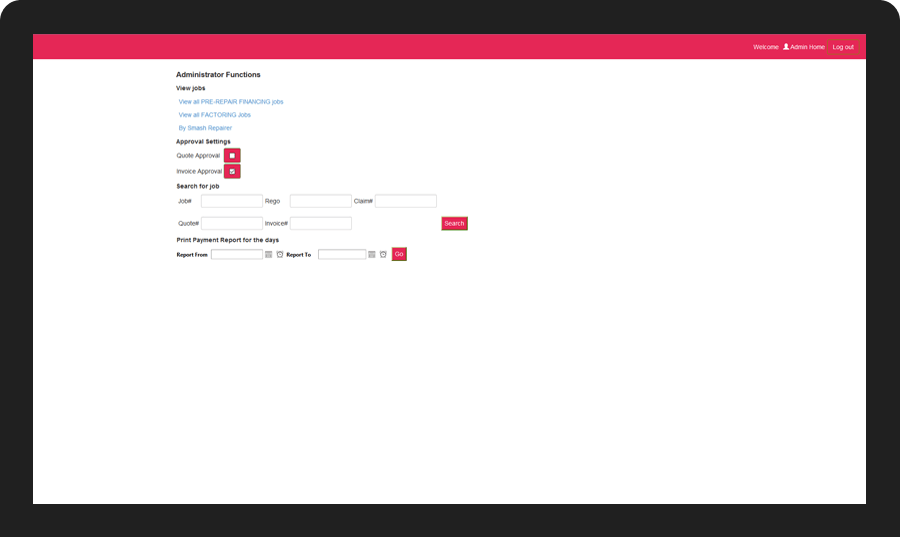

We created a fully – functional web-based automated risk and governance system with pre-repair financing, factoring decision analysis and reporting functionality.

Benefits and features

Improves the smash repairer ‘experience’ when needing to factor and invoice

The new system allows the smash repairer to either facilitate pre-repair financing or factoring when checking quote or invoice details in the ARNIE system, and can select these options via a simple tick box in the ARNIE system. Through the new system users can choose pre-repair financing or factoring in minutes, compared to the half an hour it previously took.

Improved customer experience

Insurers can now save valuable time on processing by not having to interact with ARNIE when their smash repairer client factors. Factors also experience an increase in the speed at which risk underwriting is processed by having the system fully automate the risk and decision of whether to provide pre-repair financing and factoring

Increased productivity

The new Onetick system provides seamless integration with the existing processes and procedures and can also be applied to any industry where factoring is needed or where pre-repair finance is justified. The automated system is able to capture the information, operate the proprietary risk system, alert stakeholders of missing information, track and respond to a ‘risk event’, and report on the incident. Additionally, there is also automated follow-up between the factoring company and smash repairer with an indication whether the quote or invoice has been approved for factoring or not.

Easy-to-use

The new system provides a visual interface for smash repairers, factoring companies, and insurers to view the status of the incidents in the system at all times. It allows invoice reports to be recorded and printed.

Technology

The system is built using Microsoft SQL Server 2012 Database with .NET 4.5 and IIS 7.0 Web Server. Other technologies include C#, ASP.NET, SQL, HTML 5, CSS 3, JavaScript, XML, and Web API.